Overview of the Graphite Market Downturn

The graphite market is currently experiencing a downturn, driven by oversupply and growing competition. Demand from key industries, such as electric vehicles and renewable energy storage, has weakened, and the shift towards synthetic graphite – due to its lower costs and better performance – has further contributed to the slump. While the market appears to have stabilised somewhat after steep declines in 2023, a key question remains: Given the rapidly growing global demand for electric vehicles, how long can the current graphite slump realistically last?

Price Declines and Oversupply from China

Prices for natural graphite saw a significant decline throughout 2023, with natural flake graphite falling 33.43%, from $830 per tonne in January to $530-575 per tonne by December. The downturn continued into early 2024, with prices further dropping to $470-510 per tonne by March, according to Fastmarkets. This contrasts sharply with 2021 and 2022, when growing awareness of graphite’s critical role, particularly in the electric vehicle market, sparked optimism. However, as prices declined due to oversupply and slower-than-expected growth in demand from the EV sector, the market has been left struggling. Projects that were previously seen as promising have had to grapple with tighter margins, and without a near-term price recovery, financing opportunities for new projects remain scarce.

Oversupply from China plays a major role in the current graphite slump. As the world’s largest producer, China controls over 90% of global graphite supply, and its overproduction has flooded the market, driving prices down. China’s dominance in the graphite market allows it to significantly influence prices, making it difficult for other regions to compete.

Financing Challenges for Graphite Projects

The prolonged slump has made it challenging for graphite projects to secure financing, as many are struggling to remain economically viable at current price levels. This has led to hesitation from both investors and financiers regarding the outlook of the graphite market. Projects that were once seen as promising are now considered too risky, and investments have slowed. The expectation of a market recovery in 2025, however, is likely to reignite interest in graphite-related projects as demand from EVs and battery manufacturers continues to grow.

Signals of Market Recovery in 2025

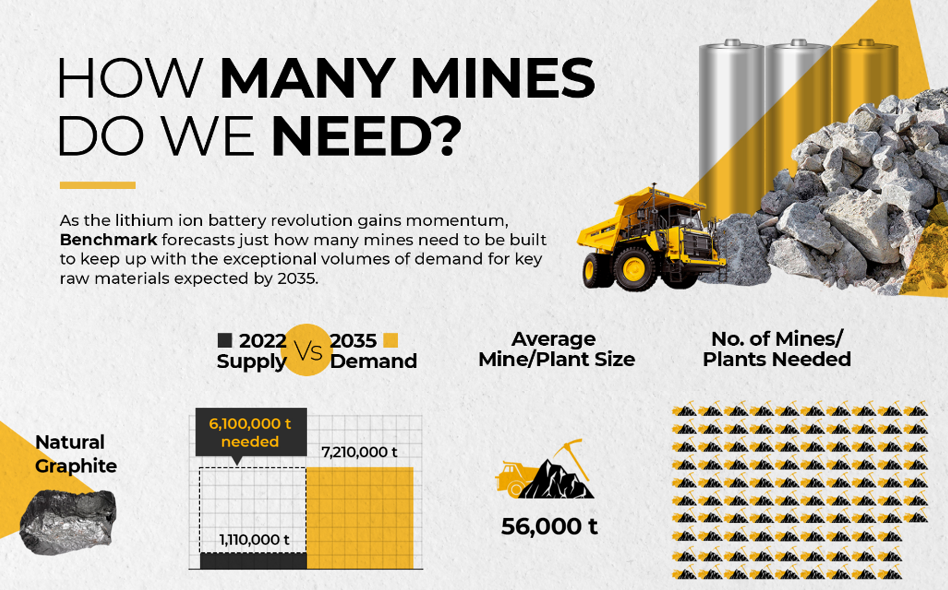

The path to recovery for the graphite market is supported by key forecasts. Benchmark Minerals Intelligence predicts the need for 97 new graphite mines by 2035, warning that shortages could persist for up to 20 years unless production diversifies, especially outside of China. Fastmarkets also forecasts a deficit in the natural graphite market until 2025, driven by soaring EV demand and delayed capacity expansions. Rising power costs and environmental controls are expected to contribute to increasing prices, making the market more dynamic in the coming years.

Looking at the macro environment, changes in government policies, such as the IRA in the US, are encouraging domestic graphite production by offering incentives for locally sourced critical minerals. Additionally, China’s export restrictions on graphite, introduced in late 2023, and tariffs on Chinese graphite imports are driving international investment in alternative sources of supply. These factors are expected to accelerate graphite production outside of China.

Several key milestones in 2024 suggest the graphite slump may be nearing its end. POSCO’s $40 million investment in Black Rock Mining’s Mahenge Project demonstrates confidence in the long-term demand for graphite. Similarly, the Australian Prime Minister’s visit to International Graphite’s Collie facility highlights the government’s commitment to supporting critical minerals and expanding local graphite production. Renascor Resources secured A$185 million in government loans to advance the Siviour Graphite Project, positioning Australia as a major future supplier of high-purity graphite for EV batteries. Meanwhile, Syrah Resources continues to ramp up production at its Balama mine in Mozambique and its US Vidalia facility, which are well-positioned to meet growing non-Chinese demand amid the Inflation Reduction Act and shifting global supply chains. These strategic developments are strong indicators of a recovery in the graphite market.

Future Outlook: A Bullish Period Ahead?

With an anticipated market recovery during 2025, when demand for battery-grade graphite is expected to surpass supply, there are growing signals that the graphite market may be shifting. Although low prices and market uncertainty continue to weigh heavily on the industry, recent developments, such as policy changes and supply chain diversification efforts, point toward a potential rebound. Rising demand for electric vehicles and government support for critical minerals are expected to help alleviate the current slump. While challenges remain, the industry is preparing to take advantage of the future outlook as supply and demand begin to realign. With tightening supply and rising prices on the horizon, the market is positioned for a stronger and more sustained bullish period.