China’s Latest Export Restrictions

China has taken another bold step in its trade war with the U.S., imposing immediate restrictions on the export of graphite-related items. The announcement, issued by China’s Ministry of Commerce on December 3, tightens end-user and end-use reviews for graphite exports, citing national security concerns. This builds on similar restrictions imposed in October 2023, when China introduced export licensing requirements for certain grades of natural and synthetic graphite.

China’s Tight Hold on the Graphite Supply Chain

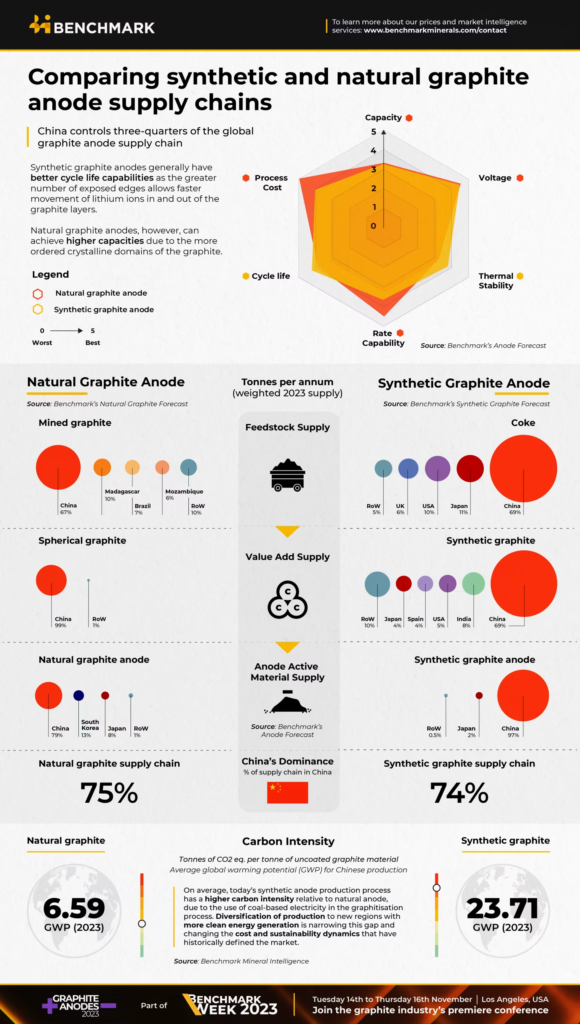

When it comes to graphite, it’s no secret that China dominates this market. China controls 99% of spherical graphite production, the processed form of natural graphite essential for lithium-ion battery anodes according to Benchmark. With 75% of the natural graphite supply chain and 74% of synthetic graphite supply under its control, China’s influence is unparalleled, and today’s announcement only solidifies this dominance.

Despite numerous companies outside of China working to either establish or increase graphite production, the West faces significant challenges in this area. China’s current oversupply and weakening graphite prices have further complicated efforts, making it difficult for non-China companies to attract investment and compete. Addressing this issue will require years of investment in mining, processing facilities, and qualification processes to establish reliable, non-China sources of graphite.

Rising U.S. Demand and the Struggle to Meet It

Although the United States currently imports relatively small amounts of graphite, demand is projected to surge. According to Fastmarkets principal analyst Amy Bennett, U.S. graphite demand is expected to rise by more than 600%, reaching almost 700,000 tonnes by 2034. To put that into perspective, the world’s largest graphite producer outside of China, Syrah Resources, operates the Balama mine in Mozambique, which can produce about 350,000 tonnes a year at full capacity. To meet U.S. demand alone in 2034, two Balama operations would be required. If China were to cut its graphite supply, where would the rest of the world source its supply from?

What Happens Next?

Given China’s ability to limit or cut graphite exports, companies in the U.S. and worldwide are expected to accelerate efforts to secure alternative suppliers, a theme that has been gaining traction for some time. However, these new restrictions could amplify this urgency. The qualification process for graphite in industries like EV batteries takes years, meaning companies must act now to secure non-China sources.

A Wake-Up Call for the U.S. and Allies

For President-elect Trump and leaders across the globe, this is a stark warning about the risks of China’s near-total control over critical minerals like graphite. The urgency to reduce reliance on Chinese graphite has never been greater. Failing to act now could leave industries facing severe supply chain disruptions or force them to remain reliant on China for graphite, leaving critical sectors at the mercy of China.