Event: Benchmark Mineral Intelligence Webinar – The Mines of Tomorrow: Graphite

Date: Thursday, 10 October 2024

Key Speakers:

- Shaun Verner, CEO, Syrah Resources (Keynote)

- Richard Carlow, CEO, True 2 Materials

- Andrew Worland, CEO, International Graphite

- Dr. Christian Graf, Director Processing Division, ANZAPLAN

Below is a summary of the key takeaways from the event

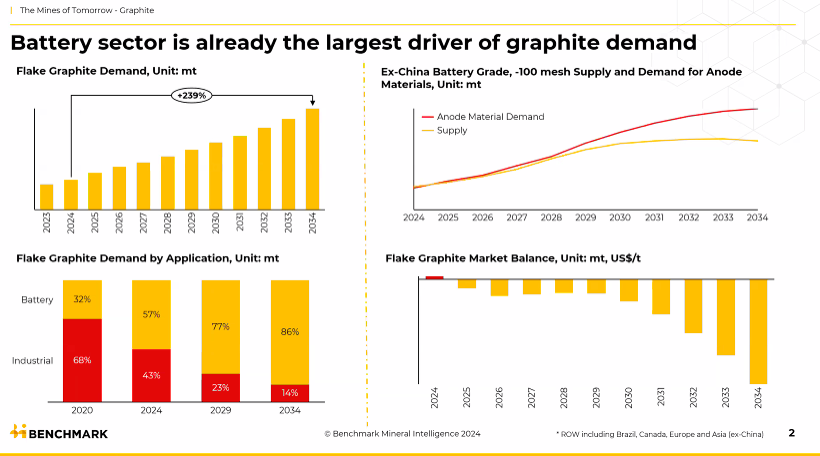

The graphite market is undergoing significant changes, as highlighted in Benchmark Mineral Intelligence’s “Mines of Tomorrow” webinar held today. Graphite, particularly flake graphite, is critical to the rapidly growing electric vehicle battery market. Demand is projected to surge by 239% by 2034, with 86% used in battery applications, up from 32% in 2024 according to Benchmark Mineral Intelligence. During this webinar, we heard from key players like Syrah Resources (ASX:SYR) and International Graphite (ASX:IG6), who are driving efforts to meet this growing demand.

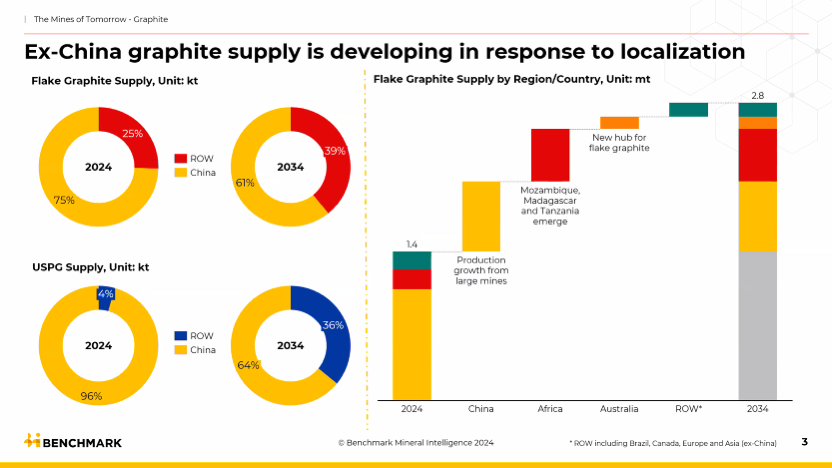

Supply dynamics are also shifting, especially with efforts to reduce dependence on China. Currently, 75% of the world’s flake graphite and 96% of spherical graphite (used in battery anodes) come from China. However, by 2034, China’s share of flake graphite is expected to drop to 61%, and its share of spherical graphite to 64%, as the rest of the world regions, including Africa and Australia, ramp up production. By 2034, ex-China companies are projected to supply 39% of global flake graphite and 36% of spherical graphite, up from 25% and 4%, respectively, in 2024. Key players in countries like Australia, Mozambique, Madagascar, and Tanzania are emerging as significant new suppliers, contributing to the global push to diversify supply chains away from China.

These shifts are supported by policy changes, such as the U.S. Inflation Reduction Act and Section 301 tariffs, which incentivise the localisation of critical minerals like graphite. As the market evolves, these trends highlight the crucial role that non-China sources will play in the future of graphite supply.

Syrah Resources

Shaun Verner, CEO of Syrah Resources (ASX:SYR), emphasised during the webinar that Syrah is strategically positioned as a leader in ex-China graphite production, with its Balama mine in Mozambique serving as a model for non-China supply. Syrah is already half a decade ahead of other ex-China downstream players, making it a cornerstone in the global graphite supply chain. Verner highlighted the company’s strong base for future expansion, with capacity utilisation being a major focus as they aim to supply enough graphite to support the production of 5 million EVs per year.

While acknowledging current challenges, particularly delays in meeting FEOC (Foreign Entity of Concern) requirements due to insufficient graphite supply, Verner noted that this has reduced the urgency for securing ex-China sources. However, this situation has worked in Syrah’s favor, as it highlights the global shortage of graphite and the significant difficulties companies face in bringing new projects into production. The limited supply reflects the broader challenges of scaling up graphite mining and processing to meet growing demand.

International Graphite

Andrew Worland, Managing Director from International Graphite (ASX:IG6) highlighted it is the perfect timing to invest in the graphite space, emphasising how the sector has faced challenges over the last 18 to 24 months but is now poised for growth. He pointed to IG6’s shallow, high-grade deposits and their strong ability to attract funding. Worland stressed the importance of educating investors and stakeholders about the graphite market, particularly the distinctions between graphite for anode materials and industrial applications.

Andrew highlighted that one of the major challenges in the graphite sector is collaborating with offtake partners to meet their stringent qualification standards, a process that is both time-intensive and expensive. As the market progresses toward 2030 and 2035, this will become even more crucial.

Summary

In summary, the graphite market is poised for growth, led by rising EV demand and efforts from companies like Syrah Resources and International Graphite to expand ex-China supply. Despite the current market slump and limited investor interest, a turnaround is expected by 2025. With new suppliers from Africa and Australia emerging and policies supporting localised sourcing, the future of graphite, especially for battery anodes, looks promising.